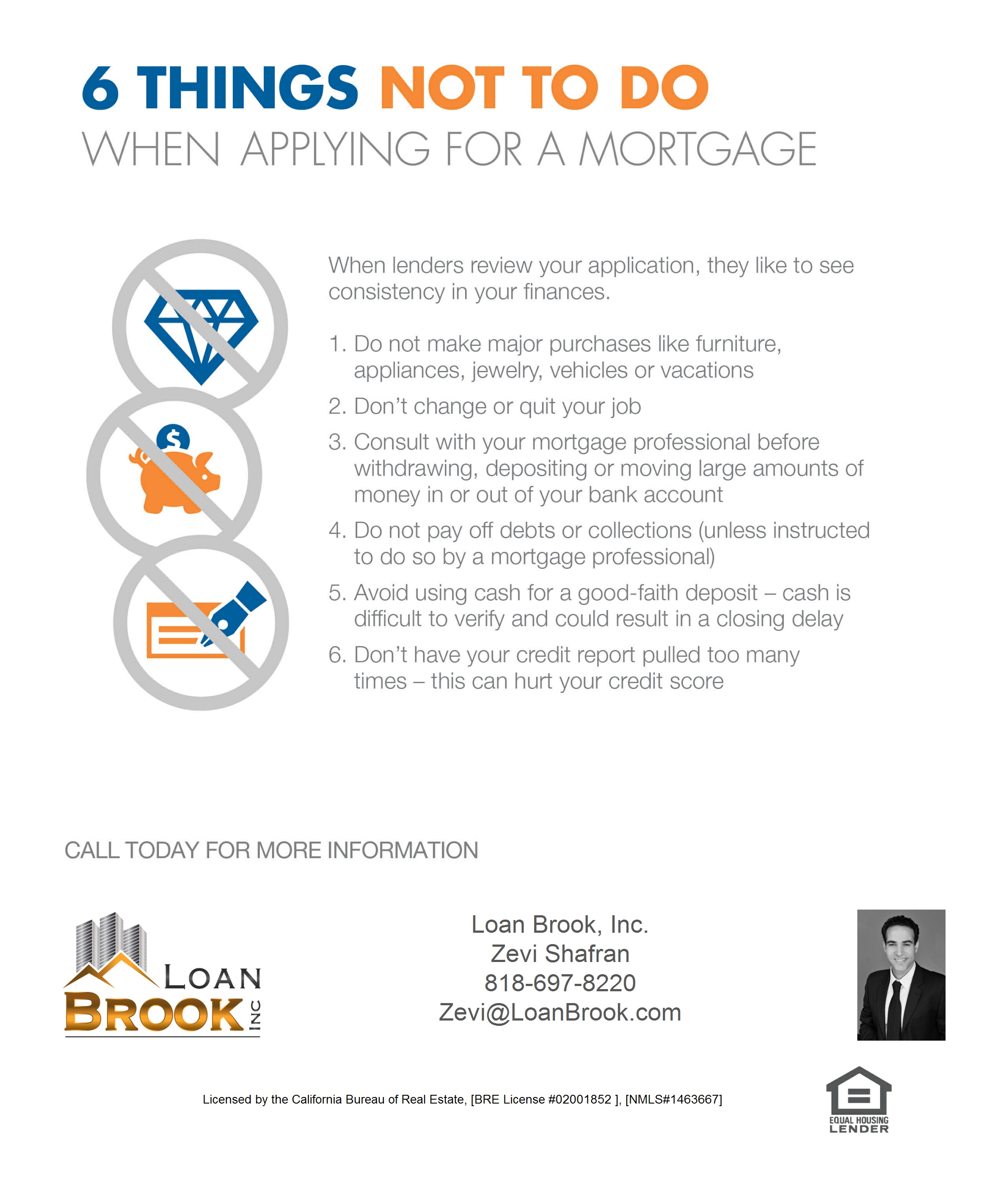

When lenders review your application, they like to see consistency in your financials. The baseline for qualifying for any loan revolves around your debt to income ratios, which means the less debt you have, the more of your income can be allocated to a loan. This also means that you can qualify for a greater loan amount with less debt! Lenders use your current income to qualify you so it’s important not to quit or change jobs if you’re thinking about applying for a new mortgage. Don’t make any large purchases as this will create other liabilities which will most often reflect on your credit and be deducted from your allocated income. Avoid cash deposits as funds to purchase a home must be seasoned or gifted and cash can’t be traced. Further, if your income is set and you deposit cash it will either be backed out or will have to be explained, but most likely will not be able to be used to qualify the loan. Lastly, avoid having your credit pulled multiple times as this will create credit inquires which will have to be further explained and documented to make sure no other withstanding debt has been extended. We are always happy to help if you have questions about qualifying for a mortgage! 🙂